Smurf Catcher: AML Scenario Simulation with Python, SQL & Power BI

- Ryan Deuter

- May 1, 2025

- 2 min read

I sought to simulate a scenario where transactions indicate structuring or smurfing. Using various tools, I aimed at improving how I would go about detecting financial malpractice in terms of AML analytics.

Link to dataset CSV: https://github.com/ryandeuter/PortfolioProjects/blob/main/test_data.csv

Link to Power BI file: https://github.com/ryandeuter/PortfolioProjects/blob/main/aml_smurf.pbix

BACKROUND: Test data set created using Python. Transaction history checked for structuring in SQL. Insights communicated with Power BI.

PROCESS: Using Google Collab, I started off importing Python libraries, such as pandas, datetime, timedelta, and random- libraries which were used to generate random data that represent structuring in AML.

# import libraries

import pandas as pd

from datetime import datetime, timedelta

import randomNext, I had to create a base time for the transactions, as well as some customer info.

base_time = datetime(2025, 4, 1, 9, 0)

customer_id = 'C123'

account_id = 'A456'Then, I created 6 different deposits of under $10,000 spaced throughout the day.

transactions = []

for i in range(6):

txn_time = base_time + timedelta(hours=i*2)

amount = random.randint(9800, 9999)

transactions.append({

'transaction_id': f'TXN{i+1:03}',

'customer_id': customer_id,

'account_id': account_id,

'timestamp' : txn_time,

'amount' : amount,

'transaction_type' : 'Deposit'

})

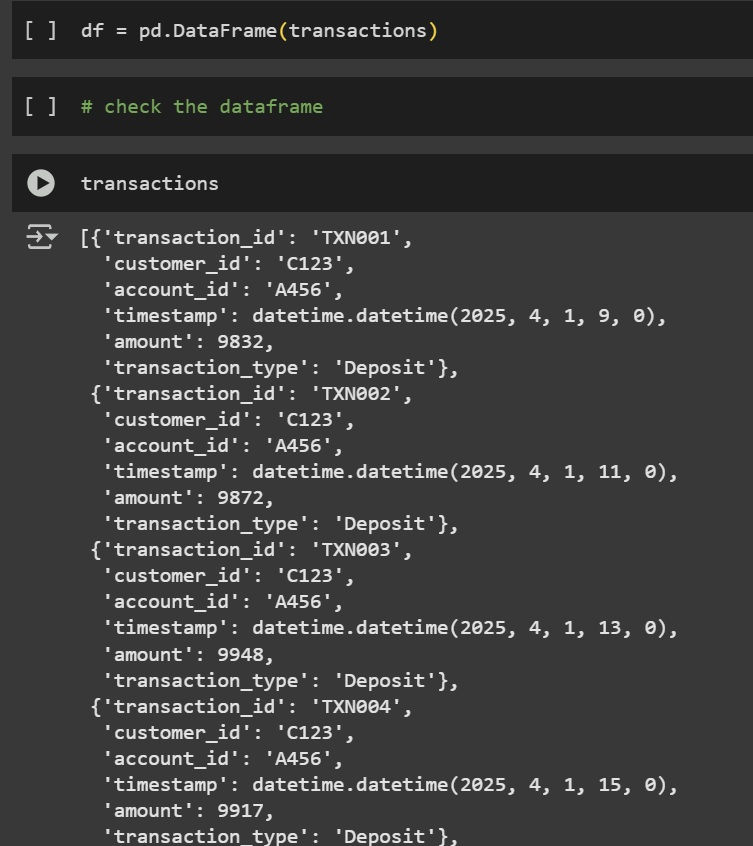

df = pd.DataFrame(transactions)So far, some of the data looks like this:

And for the final step in Python, I exported it to a CSV where I could investigate further in SQL.

df.to_csv('test_data.csv', index=False)

print("Test data saved as test_data.csv")

from google.colab import files

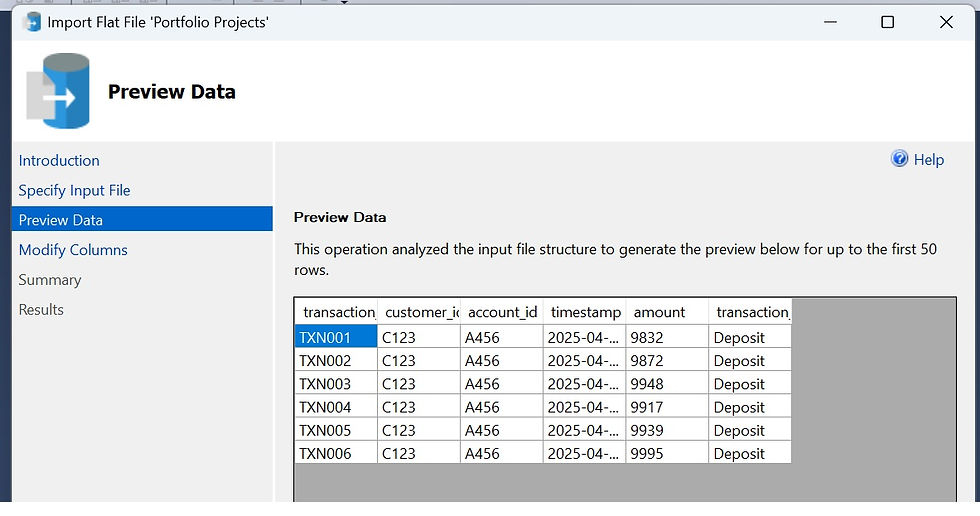

files.download('test_data.csv')Opening up Microsoft SQL Server, I imported the CSV file:

Next I ran a query to check all the data was there:

SELECT * FROM txn_dataI then chose to write the query that will check for structuring with a customer. I needed to check for amount of transactions, total amount, start and end times of transactions.

I also checked the total amount of transactions was 5 or more and the total amount was more than $45k.

Low and behold, the structuring suspicion is confirmed. Now, while this is a simulation setup with the sole purpose of recreating a structuring scenario and limiting the amount of data to highlight that, I believe the same process can be applied to larger datasets.

To add one final part to the project, I wanted to do some data visualizations in Power BI. The goal is to visualize how multiple sub-$10K deposits could indicate potential structuring behavior.

I imported the CSV, and in Power Query, I checked all the data types were ok in a data cleaning process. As this is a small dataset no removal of duplicates was no necessary. Everything else looked ok.

A line chart tracking deposit totals and times, a card visual with a total amount deposited, and a table with specific details were included to create the final dashboard.

Thank you very much for reading my project- I had a great time making it and learned a lot.

Please feel free to leave any comments below- I am always looking to improve.

Comments